[ad_1]

“The U.S. borrows in its own currency and will never actually default involuntarily as long as it has a printing press. As rising rates push that financing need higher, though, the ability of the U.S. government to change the fiscal path without politically disastrous measures like cutting entitlements or by overtly printing money is becoming more limited.

If no such radical steps are taken then it almost certainly means paying more to borrow. That rising risk-free-rate will crowd out private investment and dent the value of stocks, all else being equal.”– WSJ

Such certainly seems like a logical conclusion. However, the key to the statement is in the last sentence. Many “bond bears” suggest that rates must rise as deficits increase and more debt is issued. The theory is that at some point, buyers will require a higher yield to buy more debt from the U.S. Such is perfectly logical in a normally functioning bond market where the only players are the individual and institutional bond market players.

In other words, as long as “all else is equal,” rates should rise in such an environment.

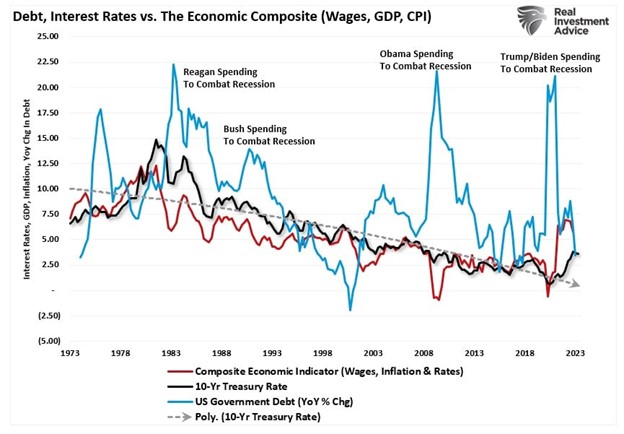

However, all else is not equal in a global economy where government debt yields are controlled by Central Banks colluding with Governments to maintain economic growth, control inflation, and avoid financial crises. Such is evident in the chart below. Since 2008, Central Banks globally have been buyers of global debt.

Why have Central Banks engaged in such a massive bond-buying program? To provide liquidity to combat the deflationary forces of debt and keep global economies out of recession. As shown, since 1980, each time the economy was dealt a recessionary blow, the Government responded by increasing debt. However, more debt resulted in a continued decline in inflation, wages, and interest rates.

The analysis becomes clearer when viewing the economic composite against the deficit.

The expectation is that “this time is different.” More debt and larger deficits will lead to higher interest rates. However, since 1980, such has not been the case. (The exception was in 2020, when sending checks to households and shuttering the economy, creating an inflation spike.) More importantly, the Federal Reserve, and the global Central Banks, remain trapped.

The Fed Remains Trapped

Before 2020, the Federal Reserve wanted higher inflation. However, after the failed experiment of shuttering the economy and sending checks to households, the Fed now wants lower inflation. Ultimately, the Federal Reserve will get its wish as rising debt levels fosters slower economic growth rates and disinflation.

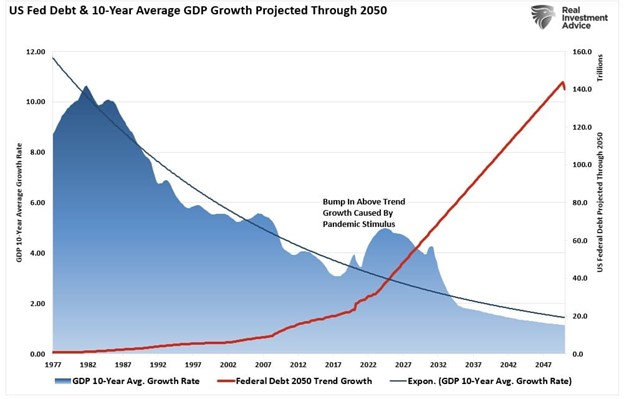

Since 1980, it requires increasing debt levels to create $1 of economic activity. At nearly $5 of debt to create $1 of economic activity, the ability to foster stronger economic growth and inflation is unlikely.

Even if the “bond bears” are correct, and increasing debt levels and deficits do cause higher rates, Central Banks will take actions to push rates artificially lower.

At 4% on 10-year Treasury bonds, borrowing costs remain relatively low from a historical perspective. However, we still see signs of economic deterioration and negative consumer impacts even at that rate. When the leverage ratio is nearly 5:1 in the economy, 5% to 6% rates are an entirely different matter.

The Fed Will Intervene

The issue of rising borrowing costs spreads through the entire financial ecosystem like a virus. Such is why the Federal Reserve and the Government will force rates lower through both monetary and fiscal policies. Such is particularly true when the interest on the existing debt absorbs nearly 1/5th of your collected tax revenues.

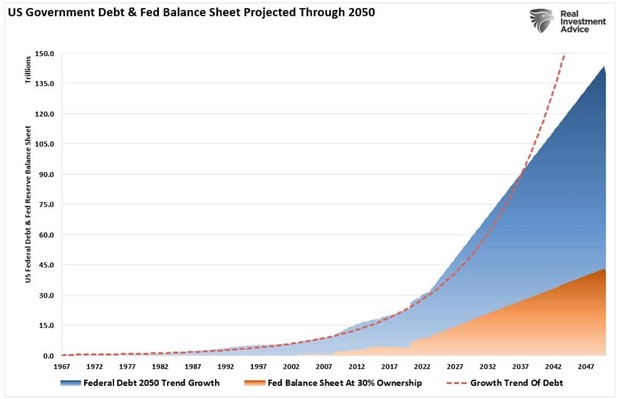

The biggest problem with the “rates must go higher” thesis is the inability of the economy to sustain higher rates due to mounting debt issuance and rising deficits. The Congressional Budget Office recently updated its debt trajectory over the next 30 years. The chart below models that analysis using the growth trend of debt but also factors in the need for the Federal Reserve to monetize nearly 30% of that issuance.

At the current growth rate, the Federal debt load will climb from $32 trillion to roughly $140 trillion by 2050. Concurrently, assuming the Fed continues monetizing 30% of debt issuance, its balance sheet will swell to more than $40 trillion.

Let that sink in for a minute.

What should not surprise you is that non-productive debt does not create economic growth. Since 1977, the 10-year average GDP growth rate has steadily declined as debt increased. Thus, using the historical growth trend of GDP, the increase in debt will lead to slower economic growth rates in the future.

Therefore, as debt and deficits increase, Central Banks will be forced to suppress interest rates to keep borrowing costs down to sustain weak economic growth rates.

If you need a road map of how this ends with lower rates, look at Japan.

This sort of problem was described by policy analyst Michele Wucker in her 2016 book “The Gray Rhino,” which was an English-language bestseller in China. Unlike an out-of-the-blue crisis dubbed a “black swan,” a gray rhino is a very probable event with plenty of warnings and evidence that is ignored until it is too late.

Add the debt to that list.

_______________

Lance Roberts is a chief portfolio strategist and economist for Clarity Financial. He is also the host of “Street Talk with Lance Roberts,” chief editor of “The X-Factor” Investment Newsletter and the Streettalklive daily blog. Follow Lance on Facebook, Twitter and LinkedIn.

© 2023 Newsmax Finance. All rights reserved.