[ad_1]

Unfortunately, most of them either don’t understand what inflation is, or pretend to misunderstand in an attempt to score political points.

I’m tired of it.

I’m tired of the parade of articles like Bidenomics Is Still Working Very Well and Why Are Americans Still Down on the Economy? and Heard Much About “Bidenflation” Lately?

I’m tired of hearing President Biden talking about the “best economy in the world” on live TV.

They want you to feel good about the economy. I get it! Instead of arguing the point, I’ll let the numbers do the talking:

- The Federal Reserve Bank of New York reports American credit card balances at a record high (over $1 trillion!)

- Housing debt, meanwhile, also at a record high of $12.6 trillion

- Since President Biden was sworn in, the overall cost of living has increased 15%

- Food: +18.3%

- Energy: +37.2%

- Rent: +13.5%

- During the same period, the U.S. debt has grown $6 trillion

- The last two $1 trillion increases occurred just 100 days apart

- That’s $10 billion a day – NOT in spending, JUST in DEBT!

Those are the numbers. I respectfully suggest that anyone typing a sentence like “Why are Americans still down on the economy?” take a field trip to their local pawn shop and ask a few questions.

Nobody likes inflation. A rising cost of living punishes everyone, rich and poor and all of us in between.

But what if we’re wrong? What if inflation is actually a good thing?

Here’s how soaring prices are actually beneficial

Recently I was on The New York Times to see how Paul Krugman was spinning the latest inflation reports.

I stumbled across the following “Inflation F.A.Q.” There was no author listed. It wasn’t described as an opinion or editorial – just presented as fact.

First I’ll tell you what it said, then I’ll tell you how it’s wrong.

Composite image with highlighting added via The New York Times

According to the Times, inflation is bad if you’re poor.

Now, here’s what they got wrong:

#1 “Inflation is a general increase in prices…”

False. Inflation is an increase in the supply of money – which causes prices generally to rise. See, rising prices is a symptom but it is not inflation itself. Clearly, they haven’t read Dr. Ron Paul’s article on the only source of inflation.

#2 “What causes inflation? It can be the result of rising consumer demand.”

False. Rising consumer demand can raise prices, yes. Supply disruptions (like a clogged channel at the Port of Baltimore) can also raise prices.

But we’ve just established that prices aren’t inflation – prices are based on two things: Supply and demand.

Come on, this is high school economics, folks! Who are they trying to fool?

#3 “Is inflation bad? It depends…”

What? No, it really doesn’t depend – inflation is deliberate wealth destruction. The purpose of the Federal Reserve’s 2%-per-year inflation target is to destroy purchasing power.

According to the Fed’s logic, if you know for sure that your money is slowly losing purchasing power, you’ll be more likely to spend it. That’s good for the economy generally even if it’s a bad decision for you personally. This is also why the Fed focuses on high-level abstractions like GDP and price indexes rather than, you know, talking to American families. False.

#4 “…price gains can lead to higher wages and job growth.”

Misleading. It’s the use of that word “can.” It’s like saying, “Drinking and driving can lead to a complimentary ride and a free photo session.” This is true, right?

Both are equally true.

Also, note the weaselly shift in terminology from “inflation” to “price gains”? Doesn’t that make paying more at the grocery store sound a little less problematic?

Here’s the problem: While rising prices may lead to higher wages, and may lead to “job growth” (promotions? New openings?), they absolutely lead to a higher cost of living. Workers demand higher pay when they can’t feed their families!

To them, this is a good thing?

#5 “How does inflation affect the poor? Inflation can be especially hard to shoulder for poor households…”

True. The lower your income, the more you suffer. It’s tragic and that makes it even more infuriating that some anonymous Times staffer is trying to downplay the brutal effects inflation has on the poor.

Now, obviously all this is nonsense. If the Times really believed inflation was so beneficial for everyone except the poor, why would Paul Krugman be turning himself inside out inventing new metrics that show inflation is a mirage?

It’s a game. It’s gaslighting. It’s truly upsetting mostly because I believe that little Times FAQ that appears on a number of pages on their website will have a lot more readers than I do – and some of them might actually believe it.

Interestingly, they did manage to get one more thing right…

Tangible assets really have held their value better

From this same “FAQ” there’s one verifiable claim:

“Financial assets in general have historically fared badly during inflation booms, while tangible assets like houses have held their value better.”

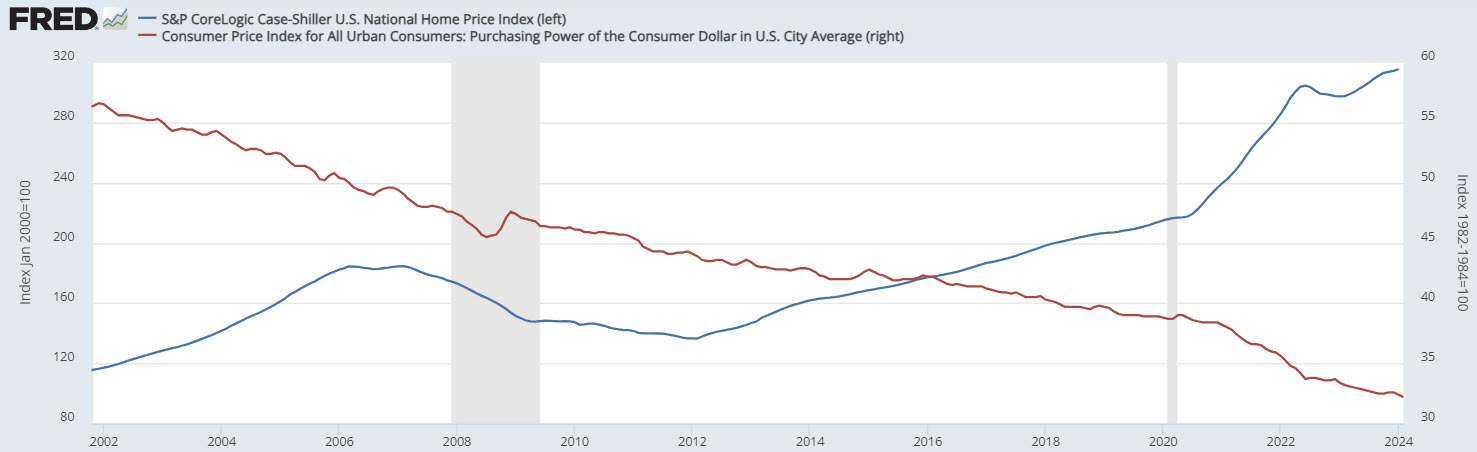

They didn’t make it up! See below – as purchasing power declines, home prices rise. There’s not a strong correlation exactly but there is a very clear trend:

Houses aren’t the only tangible asset though.

To summarize:

- Inflation means an increase in the supply of money, which devalues the money

- Rising prices are caused by inflation – they aren’t inflation itself

- Inflation is bad…

- …especially if you’re poor

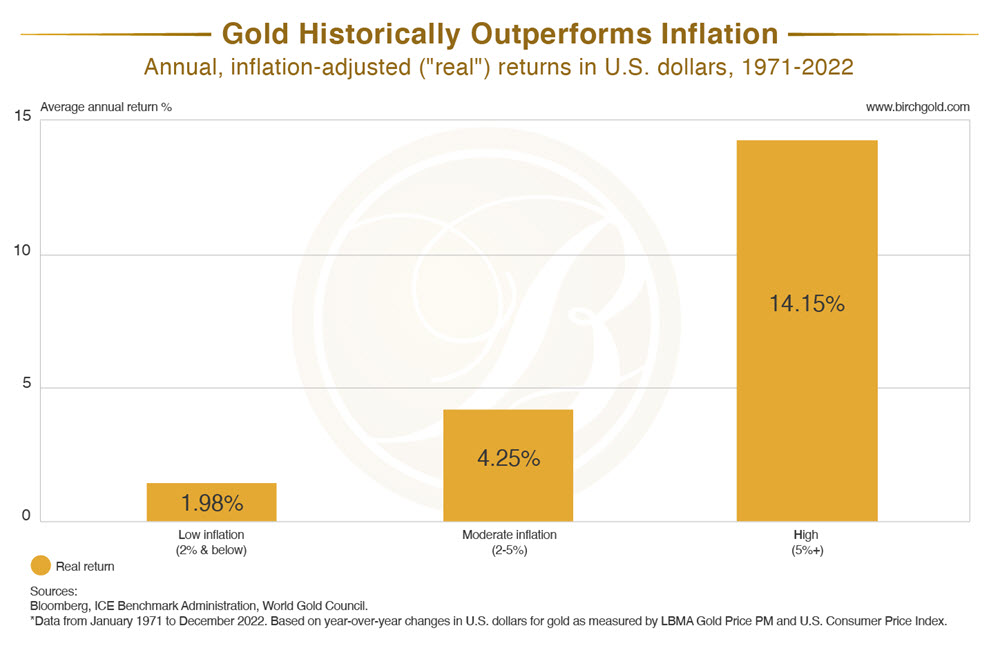

- Tangible assets are your best defense against inflation

One of the primary benefits of owning physical precious metals is just how much less trouble they are compared to real estate. Have you ever tried to sell a house? Think for a moment about the costs and time that takes. Real estate is tangible, yes, but it isn’t liquid. It’s not easily converted into cash when you need it.

It’s also quite frankly very difficult to buy a house in a tax-sheltered retirement account. That’s another place where physical precious metals shine – you can open a gold IRA easily.

I know I can’t do much to set the record straight here… This is the best I can do. Please don’t let the gaslighting get to you – please do what’s best for you and your family, regardless what the Times wants you to believe about inflation.

_______________

Phillip Patrick is Birch Gold Group’s primary spokesman and educator. He was born in London and earned a politics and international relations degree at the prestigious University of Redding in Berkshire, England. Growing up in London, he saw the risks of government overreach and socialist policies first-hand. He spent years as a private wealth manager at Citigroup on Lombard Street (the Wall Street of London). He joined Birch Gold Group as a Precious Metals Specialist in 2012.

© 2024 Newsmax Finance. All rights reserved.